Mark D Martin MRAeS, CEO, Martin Consulting

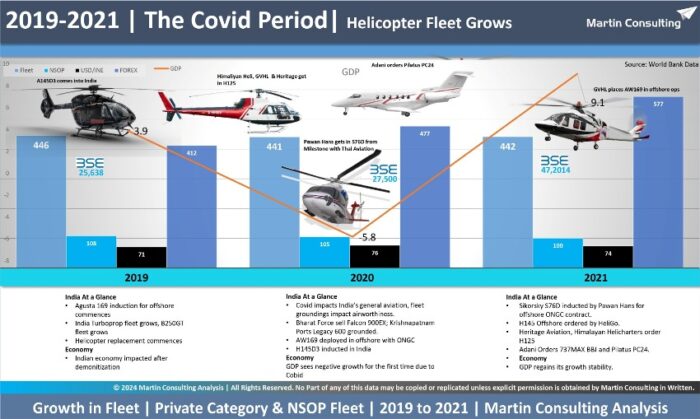

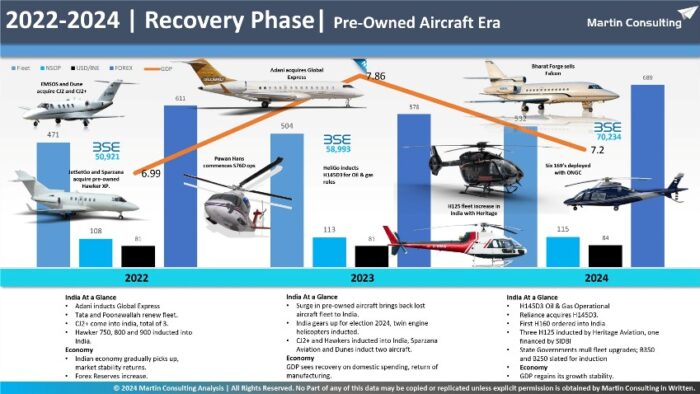

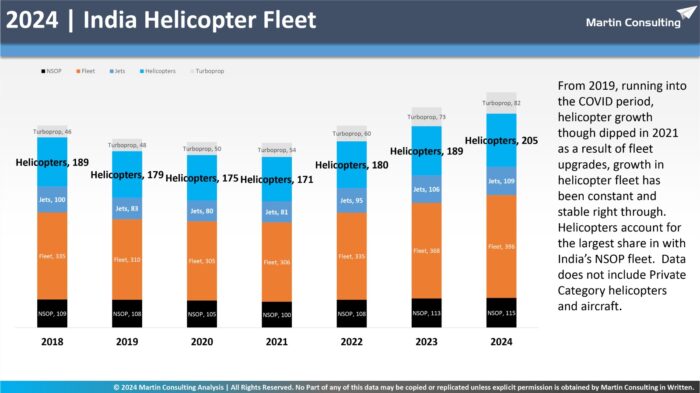

Post COVID, pre-owned and new aircraft and helicopter charter (limited to NSOP operations) fleet grew its strongest in India with a year on year growth of over ten percent, the highest growth return with Business and Charter aviation ever recorded for India.

From a depleting fleet size of 446 aircraft in 2019, India’s combined charter fleet (excluding private category ownership aircraft) grew to over 490 (state government fleet and Private Category Aircraft are excluded) aircraft by 2024 October, an addition of nearly 50 aircraft and helicopters in 5 years, or 10 aircraft and helicopters year on year, the highest recorded for South Asia, according to analysis done by Martin Consulting exclusively for Aviation World Magazine.

What’s interesting to note is that that the emergence of new charter companies, both market retail charter companies as well as large corporate owned and operated captive service operators rose from 108 to 115 between 2019 to 2024 and this signals continued commitment with offering newer fleet and improved capacity offering.

The factors that helped grow India’s aircraft fleet has been centered with the increased demand of corporate flying, a dramatic rise in charters and private travel amidst the COVID pandemic and a more fundamentally stable Indian economy with the rise of India’s new digital economy and the emergence of the industrial revolution 4.0 trend in FMCG and services in India.

Traditional air logistic requirements grew India’s helicopter fleet from 2019 to 2024 with the addition of first time twin engine helicopters. Sikorsky S76D’s and the H145-D3 OG fleet grew in India amidst the background of an aging Eurocopter AS365N2/N3 and Bell 412EP fleet operated by Pawan Hans and Global Vectra HeliCorp.

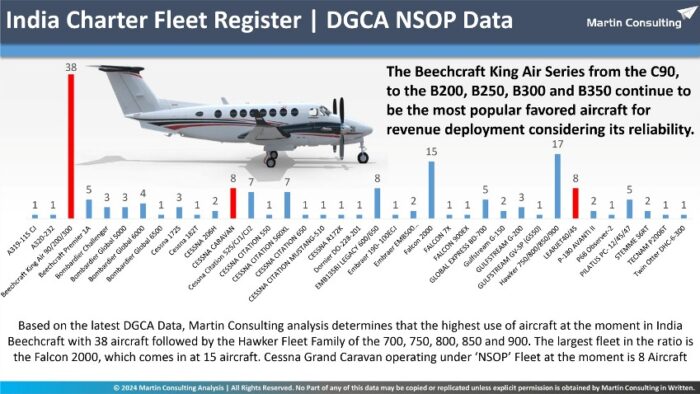

Growth in mid-size and super mid-size Jets has been the strongest in India with the sharp rise of pre-owned aircraft into India’s NSOP register. The notable drivers of this trend was the addition of the Hawker 800XP and 900XP Fleet, the Hawker 4000, Citation CJ2+ and the first time induction of the Pilatus PC24 aircraft fleet with Adani – Karnavati Aviation.

India’s Dassault Falcon fleet grew in the backdrop of traditional corporate NSOP’s and first time operator Wonder Cements/RK Marble Group, in addition to high utilization of the Falcon 900 by Reliance Industries Limited.

During the last five years, India saw the re-emergence of long range jets with the acquisition of the Boeing BBJ-MAX by marquee corporates Adani and Reliance, the Gulfstream G550 and G650 and the Bombardier Global Express.

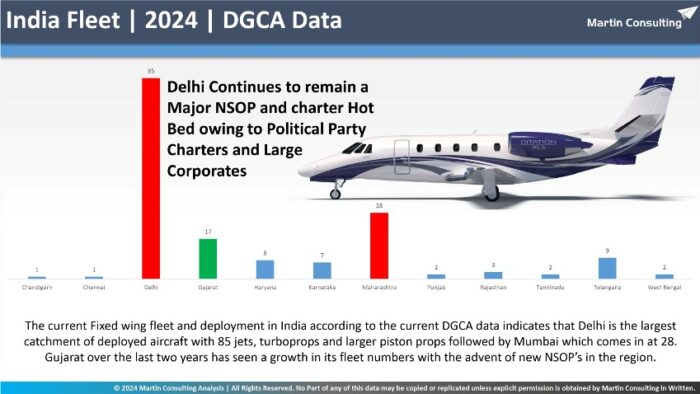

PRE-OWNED VS NEW AIRCRAFT

Growth of India’s jet fleet grew with the addition of pre-owned aircraft driven by the emergence of new charter companies. Effective fleet in numbers were driven by the Hawker 750, 800 and 900 aircraft in addition to induction of the India tested and proven Beechcraft B200, 250 and 350. Light Jets emerged as a key trend in India with the CJ2+ being inducted into India. The ratio of pre-owned to new aircraft induction till 2024 stands at a 70:30 ratio with pre-owned aircraft leading the trend. India’s collective fleet continues to be deployed mostly in North India driven by increased use by corporates and with election and political party charters. Mumbai and Gujarat follows Delhi as effective aircraft basing as a result of the sudden emergence of corporation aviation.

INDIA FLEET BREAK UP | 2024 MARTIN CONSULTING ANALYSIS

Turboprops, driven by the Beechcraft B200/250, 300/350 and Pilatus PC12; Jets led by the Hawker, Dassault Falcon and Cessna Citation Fleet and Large Jets drive India’s fixed wing aircraft fleet in India. While collective numbers of the Bombardier Global Express and the Legacy 600 and 650 have risen, the demand of light, mid-side and super mid-size jets is attributable to the market attainable charter rates which are on offer.

India’s charter market historically and traditionally has been price sensitive with rates structured more under adhoc and less ACMI based longer contracts. Although recent trends with Political Party and Election charters have been suggestive with determining a partial emergence with ACMI long term charters, India’s market is yet to fully mature in this segment.

HELICOPTER FLEET GROWTH IN INDIA

India’s Helicopter fleet overshadows the business jet and turboprop fleet by nearly twice its size owing to increased demand and utilization by offshore oil exploration companies, offshore and onshore oil and gas helicopter companies, high altitude pilgrimage heli-taxi operators flying to India’s pilgrimage sites at Kedarnath, Badrinath, Gangotri and Yamunotri and Amarnath. State Government dependence on helicopter operations continues to be strong in view of increased deployment of flights in districts and regions which are at the moment limited to a helipad and very rudimentary airfield and landing strip access.

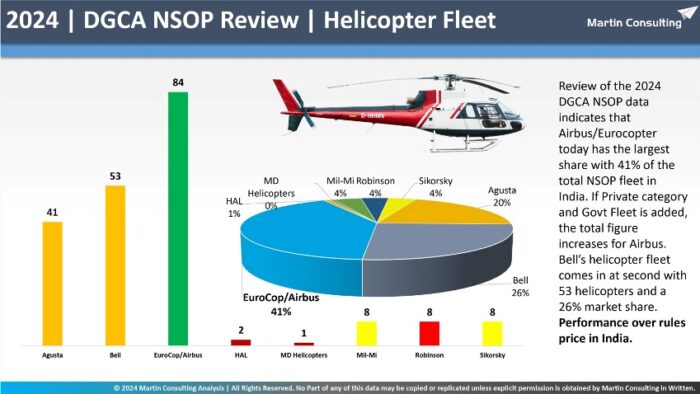

The demand for high performance and agile light single engine helicopters such as the Airbus/Eurocopter H125/AS350B3e helicopter has been on account of the helicopter’s proven capability of operating in India’s Himalayan mountains and with aerial work. Charter operators Heritage Aviation, Himalayan Helicopters, Global Vectra, HeliGo and Pawan Hans continue to drive India’s fleet in effective numbers.

India’s offshore oil and gas region has played a pivotal role with driving India’s twin engine helicopter fleet with the AW139, AW169, Bell 412 and now most recently, the H145-D3 OG in production flying. Although the S76D has been one of the most stable and reliable helicopters in offshore oil and has in South East Asia, India has had a hit and miss moment with S76 deployed with Pawan Hans.

Airbus/Eurocopter continues to be market lead in Indian market with over 84 helicopter in active revenue service totaling to a combined market share of 41% followed by Bell Helicopters at 53 helicopters with a market share of 26% and Agusta/Westland/Leonardo with a share of 20% and 41 helicopters.

While the ratio single to twin helicopters in India tilts in favor of Twin Engine helicopters in view of ONGC’s AS4 requirements, India soon is expected to adopt definitions and guidelines as defined by the International Oil & Gas Producers Association (IOGP) for offshore operations which mandates helicopter LIVE tracking (currently restricted in India), cockpit and tail camera’s, Helicopter Health Monitoring System, LIVE-Realtime Active Vibration Monitoring and Real Time Engine Condition Trend Monitoring.

While over the last 5 year period, Single Engine helicopters stole the limelight with H125’s and H130’s being inducted by Himalayan Helicopters and Heritage, Twin Engine Helicopters continue to be the mainstay of India’s rotary wing backbone.

EMERGING TREND | 5TH GENX HELICOPTERS AND AIRCRAFT

Till recently, India maintained a status quo with not wanting to switch over to newer generation aircraft and helicopters and kept a stance with sticking with aircraft operated before, aircraft familiar with and aircraft that already had adequate engineering, maintenance and flight crew available. A lot of that has changed owing to the following global drivers that are pushing aircraft operators to adapt to new aircraft and helicopter platforms. These are:

Terminating Production Line of Aircraft and Customer Support for aircraft such as the Hawker 700, 750, 800, 850 and 900 fleet; and the G200/IAI Galaxy.

Availability of spares for critical ATA Chapters under Windows, Doors, Avionics, Hydraulics, Flight Controls, Cabin and Furnishings and landing gear.

Changing AD, SB and MOD Requirements including imperative Regulatory Compliancesfor the installation of the EASA mandatory 88 parameter DFDR and CVR.

The recent addition of the Pilatus PC 24 aircraft in addition to induction of the Hawker 4000 (though limited in numbers globally, but new to India) and helicopters such as H160 and Sikorsky S76D indicates India’s willingness to work on the compliance and Type Certification of aircraft with newer Type Certificate Data Sheets (TCDS) and adapt to newer aircraft technology.

Progressive Corporates such as Reliance with its recent order for two H160 helicopters, HeliCharter operator Chipsan Aviation Dry Leasing an H160; and Adani acquiring the PC24 replacing its Hawker 850XP for operation into mining sites have set the benchmark for other operators.

India’s Corporate Aviation, Business Aviation and charter operators are soon expected to induct newer more progressive long range aircraft as the Gulfstream G650, Airbus 220-ACJ and the HondaJet Elite by 2026.

Image Courtesy: JetPhotos, Marka Bleuer, Adani Pilatus PC24

CHALLENGES IN BUSINESS AVIATION, CORPORATE AVIATION & THE CHARTER BUSINESS

Deal Transparency | One of the biggest challenges with the acquisition of business aircraft in India continues to effective transaction management and deal transparency.

Recent Geo-Political challenges with Russian owned aircraft being sold on extremely short notice through dubious, cloaked SPV’s in Dubai has given dramatic rise to the trend of ‘Back-to-Back’ sale transactions where it has noted and widely criticized that brokers have been misleading buyers and sellers with the actual value of aircraft, its maintenance state, airworthiness condition and compliance status with AD’s, SB’s and ASB’s.

Collectively, it is extremely relevant to state here that industry associations including the EBAA, NBAA and Aircraft Broker Associations take responsibility with ensuring its members conduct ethical and transparent aircraft transactions and deals so as to not hurt the aircraft buyer or the seller.

Installation of European Aviation Safety Agency Mandated DFDR | Aircraft being inducted into India from jurisdictions that are mostly governed under regulations by the Federal Aviation Administration require the mandatory installation of Digital Flight Data Recorders with 88 parameters including Cockpit Voice Recorders. In most cases, STC’s for DFDR’s to be installed either don’t exist, or DFDR’s continue to not be the inventory with component vendors and MRO’s. Aircraft’s that are affected due to DFDR’s and STC’s not being widely available are the G200/IAI Galaxy, Hawker 4000 and the Citation CJ2+.

Medium Utility Airbus H160 Helicopter

Aircraft Financing | Financing, Loan Syndication and Amortization for pre-owned aircraft along with high interest rates continue to be major challenge. While some Indian banks such as Yes Bank, SIDBI, ICICI, HDFC and Axis Bank in the past have had an exposure with aircraft and helicopters, India does not have a purpose created and/or specialist financial institution that is able to support the industry with comprehensive financial assistance for the buying aircraft and helicopters.

Crew & Training | With nearly 520 aircraft in India’s charter register, it is surprising to note there exist No Business Jet, Helicopter and Turboprop Simulator in India. Despite Dassault Falcon, Beechcraft King Air and Airbus/Eurocopter being market leaders in the Indian market, none of the Airframers and OEM’s have taken steps to set up simulator and training centers in India.

DGCA Regulations | India’s business aviation, corporate aviation and charter fleet grew in the backdrop of a stable Indian economy and for fleet growth to continue, it is imperative that more conducive entry regulations including lesser downtime for the start up of operations and registration of aircraft. While steps are being taken by the DGCA to make regulations more progressive, a more liberal, open minded and cohesive approach is the need of the hour.

MARKET OUTLOOK & FORECAST | 2024 TO 2029 | MARTIN CONSULTING

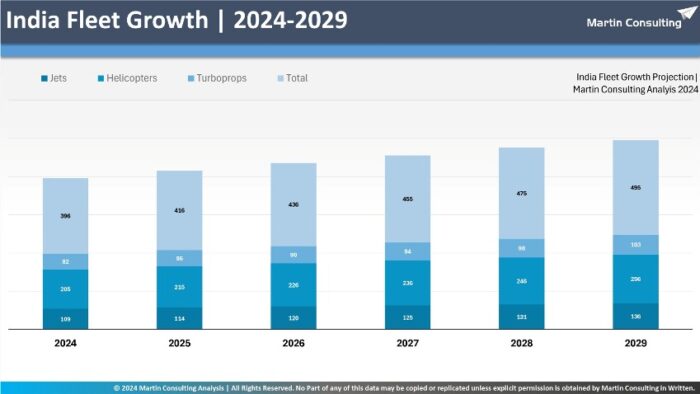

Based on trends noted with growth of India’s helicopter, business jets and turboprop aircraft in India which stands at a modest 7% growth noted since 2015, assuming that market conditions including external factors such as the Ukraine Russia Conflict, instability in the Middle East and the gradual recovery of BRICSA economics, Martin Consulting estimates that India should induct an additional 80 helicopters by 2029 further boosting pilgrimage connectivity, the offshore oil and gas sector and travel flexibility of India’s corporates and the travelling public.

Martin Consulting estimates that India will add close 50 business jets into our fleet keeping in view the surge demand for charters and the continuous fleet and jet capacity modernization, which turboprops are expected to grow to 115 aircraft from the present 82.

CONCLUSION

India’s business jet, helicopter and turboprop fleet has grown organically over the last 30 years of its recorded existence and this growth has been solely on the demand and need for charter travel to regions and airports that are inaccessible and remote.

Industrial houses and large corporates along with the oil and gas sector in India have played the most critical role with driving out charter aircraft and helicopter fleet.

While state governments too have transitioned from Piston aircraft entirely to Turboprops, Helicopters and Jets, we anticipate the Government owned aircraft fleet will continue to grow amidst focus with state economic and infrastructure development.

The trend that India noted back in 1990’s with Central Government Ministry’s owning and operating aircraft and helicopters for Government duties is yet to be seen.

Martin Consulting estimates that Jets and Helicopters will grow the most in India both as part of fleet replacement and induction of new aircraft. With the Airbus H125 Final assembly line expected to commence in 2026, we are likely to see a structured drop in the cost of the A125 helicopter allowing for more operators to acquire and grow the total fleet of helicopters. India’s NSOP, Corporate and Business Fleet is on the cusp of a comprehensive transformation and according to the data, should help create additional revenue for airports, air navigation services and soon become a strong provider of jobs, in addition to help contribute GST back for India’s economic development.

The Author is Founder & CEO of Martin Consulting an aviation consulting, research and safety firm based in South Asia. Martin Consulting works with business jet companies, helicopter operators engaged in offshore oil and gas, air taxi helicopter services, airlines, MRO’s, Governments and Banks with strategic advisory, safety and SMS, Compliance and Assurance.

DISCLAIMER:

This report was exclusively developed for Aviation World Magazine. All data, research, graphics and analytics in this report is copyright of Martin Consulting. No part of any of this report may be reproduced, replicated, copied or made into derative works without the explicit written permission of Martin Consulting and the Author Mark D Martin.

The author can be contacted at mark@martinconsulting.aero